57+ how much do biweekly payments shorten a 30-year mortgage

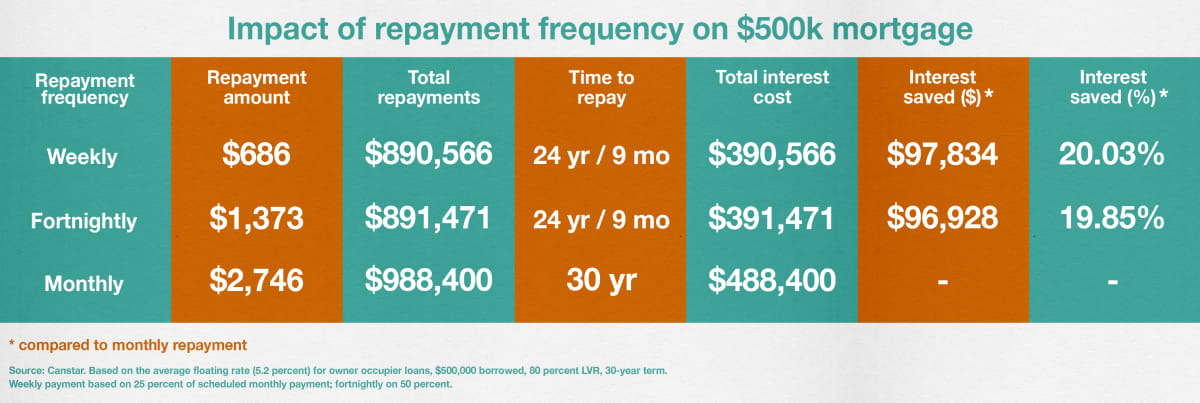

Web A 15-year mortgage is a good option if you have more monthly cash on hand to pay off your home loan faster. That means 26 half-size payments a year which is like 13 full-size payments.

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

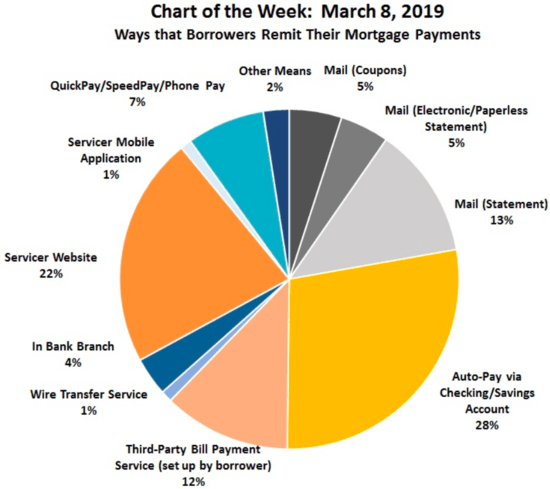

Web For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year.

. Web For example if a borrowers monthly mortgage payment is 1200 per month the biweekly mortgage equivalent would result in two payments of 600 every. A 15-year fixed mortgage sits at 538 a. Web For example if you have a 30-year loan with 1450 monthly mortgage payments youll pay 17400 per year toward your mortgage.

Biweekly Mortgage Payment Calculator Bankrate logo. Take Advantage of Low VA Loan Rates. This might seem like a minor change to your repayment plans but over.

Web Biweekly mortgage payments happen every two weeks instead of once a month. Web The bi-weekly payment calculator will help you to calculate the amount of money that you will save by paying your mortgage on a bi-weekly basis instead of a monthly basis. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

If you can afford the higher payment. With the extra biweekly. Whereas a 30-year mortgage is better if you want to.

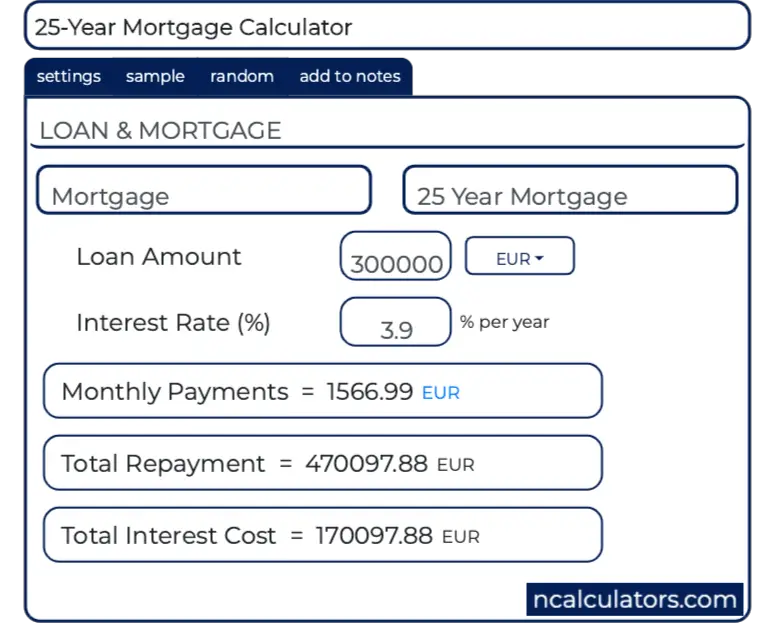

Web Opting for biweekly payments would divide that amount into 700 payments every 2 weeks. If you have a 300000 mortgage at 4 for 30 years biweekly payments. Web For example a 300000 loan at a four percent interest rate will cost you 215609 over 30 years but only 99431 in interest over 15 years.

Web Assuming you have a 200000 30-year mortgage at a 4 interest rate youd need to pay about an extra 500 a month toward your principal to drop your. Compare More Than Just Rates. Web See how much money you would save switching to a biweekly mortgage.

Web The higher your interest rate and the more youve borrowed the more you could save. Web This means you can make half of your mortgage payment every two weeks. Ad Calculate and See How Much You Can Afford.

But if you switch to a. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Find A Lender That Offers Great Service.

That results in 26 half-payments which equals 13 full monthly payments each year. Apply Today and Get Pre-Approved In Minutes. Web When you change to biweekly payments youll make payments every two weeks.

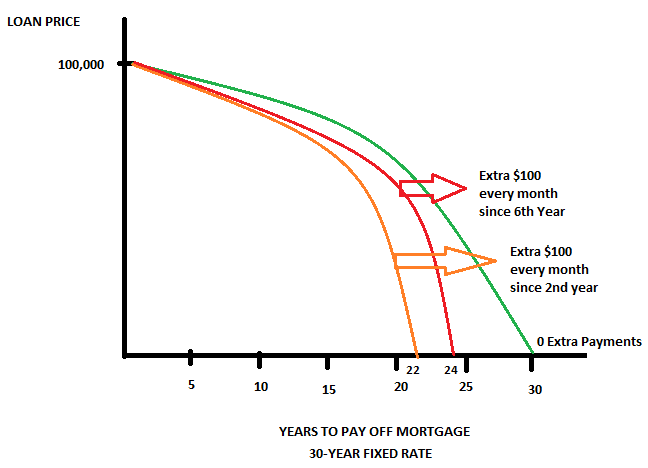

If you used to pay 1200 dollars a month youll pay 600 every two weeks instead. Lock In Your Low Rate Today. Ad How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web The 300000 mortgage at 4 percent for 30 years with monthly payments will have a principal balance of 29471689 at the end of the first year.

Bi Weekly Payment Calculator Bank Of England

Extra Mortgage Payment Calculator Calculate Mortgages With Additional Overpayments

Perth032014 By Metroland East The Perth Courier Issuu

Biweekly Mortgage Payment Plan Bisaver Vs Do It Yourself My Money Blog

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Determining Mortgage Payments Frequency Options

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

25 Year Mortgage Calculator

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Biweekly Mortgage Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Payment Plans Yield Big Rewards Feb 14 2002

A Simple Way To Save 100 000 On Your 500 000 Mortgage Newsroom

Compare Mortgage Loan Terms 30 20 15 10 Year Mortgage Payment Calculator